- MORTGAGE BROKER AGREEMENT IN PRINCIPLE FULL

- MORTGAGE BROKER AGREEMENT IN PRINCIPLE SERIES

- MORTGAGE BROKER AGREEMENT IN PRINCIPLE FREE

You've got issues in your credit history.There are a few reasons why a lender might decide they can’t offer you an AIP: What stops you getting an Agreement in Principle? How long does an Agreement in Principle last?

MORTGAGE BROKER AGREEMENT IN PRINCIPLE FREE

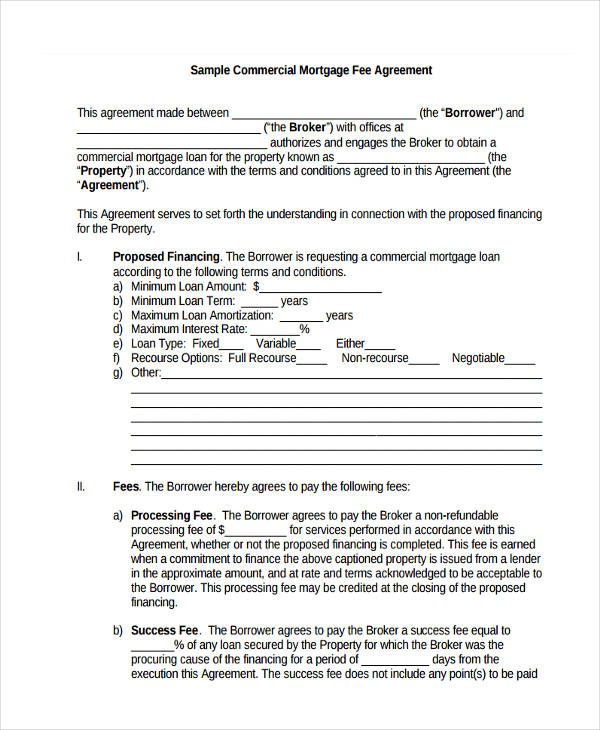

It may take a long phone call to provide this info, but once you do you can get an Agreement in Principle in a few minutes.Īgain, if you want to use Mojo's free broker service we can submit these documents for you.

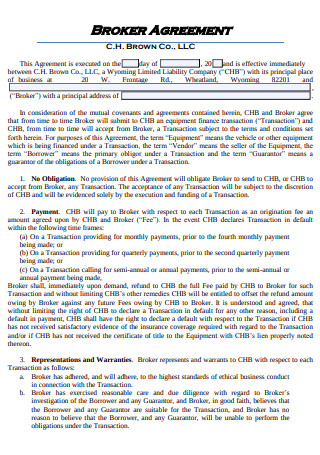

This will do for most providers and they get most of it from the credit search: What do I need to get an Agreement in Principle? They'll also look at your current financial circumstance to decide just how much they are willing to lend you. Most use a soft search, but some still use a hard search How do I get an Agreement in Principle (AIP) or Decision in Principle (DIP) from a lender?Ī lender uses info from a credit check to decide whether they’re able to offer you an Agreement in Principle. If you choose Mojo as your broker, we can help you through this process and check all your paper work is correct before we submit it. You will need to submit documents to the lender and they will run their own credit check. The major difference is that when you get a Mortgage in Principle from a lender, you're embarking on their mortgage application process. Is the Mojo document the same as you get from a bank?īoth tell you how much you can roughly afford to borrow and both show that you have no major credit or financial issues that would prevent you getting a mortgage.Įqually both can be used to help you make an offer on a house. Use the online mortgage broker Mojo Mortgages to get yours. You can get a Mortgage in Principle with help from Mojo Mortgages in just 15 minutes, all from your laptop or phone and all for free. Nevertheless, they’re useful if you’re house-hunting and they are a good first step to knowing that you could get a mortgage. It’s just an indication of what you could be eligible for based on a basic assessment. How reliable is a Mortgage in Principle?Ī Mortgage in Principle is not a mortgage, or even a guarantee that you’ll get one. If a lender is going to use a hard credit check, they’ll tell you first.

MORTGAGE BROKER AGREEMENT IN PRINCIPLE SERIES

It’s not guaranteed that you will be able to borrow this amount.If your application is rejected after a hard credit check, your credit score may suffer – particularly if you get a series of these rejections in a short space of time.Īlmost all lenders (and Mojo) use a soft credit check to assess whether they can provide you with an Mortgage in Principle, which doesn’t leave a record on your credit report. It doesn’t mean you’re guaranteed to be approved It’s also important to understand what a DIP isn’t: If you have a bad credit history, or other factors like self-employment that have affected your mortgage application, it can give you the confidence that you’re in a strong position to put in an application.Įstate agents will often want to see confirmation you have a DIP in place before accepting an offer on a property, and it makes the process a little smoother and easier for the seller too – they’ll know you’re serious enough about the property for them to take it off the market. It can help you get an indication about the size of mortgage you’re eligible for, which helps you to determine how much deposit you’re going to need and the options that are available to you.

It’s a strong indication that you’re likely to be approved, as long as you meet the criteria set out by the lender who you apply with. And they typically last for between 30 and 90 days, depending on the lender.

MORTGAGE BROKER AGREEMENT IN PRINCIPLE FULL

You need one before you can submit a full mortgage application. The DIP takes into account whether you can afford to borrow the amount that you’re wanting to, based upon your income and regular outgoings, as well as the results from a soft credit check and any other lending criteria. It confirms they’d be happy for you to borrow money from them. A Decision in Principle is a confirmation from a lender that they’re willing to lend you a certain amount of money to purchase a property. A DIP can also be called an Agreement in Principle (AIP), or Mortgage in Principle, a Lending Certificate or mortgage promise.

0 kommentar(er)

0 kommentar(er)