- OUTSTANDING INVOICES LETTER TEMPLATE HOW TO

- OUTSTANDING INVOICES LETTER TEMPLATE FULL

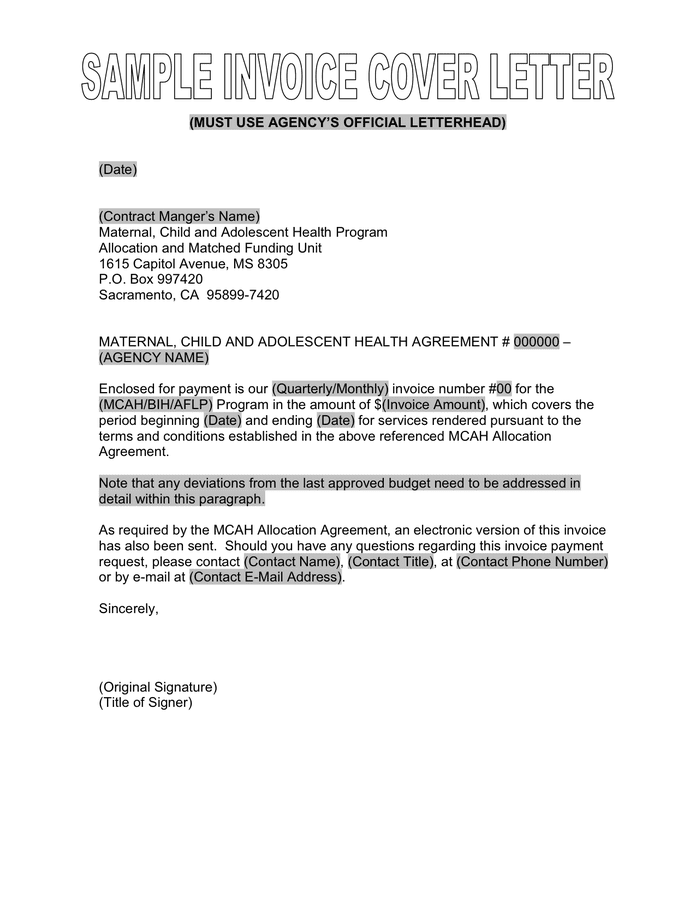

In addition, if the debtor is living paycheck to paycheck, is best to have an installment plan ($/week or $/month). The basic approach is to enter how much is owed followed by a discounted amount if the debtor pays within a specific timeframe. Step 4 – Enter the Payment OptionĮnter the payment options (select as many as desired). Step 3 – Complete the Debtor’s DetailsĬomplete the details of the Debtor by mentioning their name, when the balance is due, and what the balance is in regard to. If there is any evidence of the amount due, such as an invoice, it should be attached. Note that any taxes, interest or penalties should be totaled into one sum. The amount due by the debtor should be included in the Final Demand Letter. The date of the letter should also be included. In the header, the company or individual requesting payment should be entered with their contact information.

OUTSTANDING INVOICES LETTER TEMPLATE HOW TO

How to Write a Final Demand Letter Step 1 – Enter the Header Information

OUTSTANDING INVOICES LETTER TEMPLATE FULL

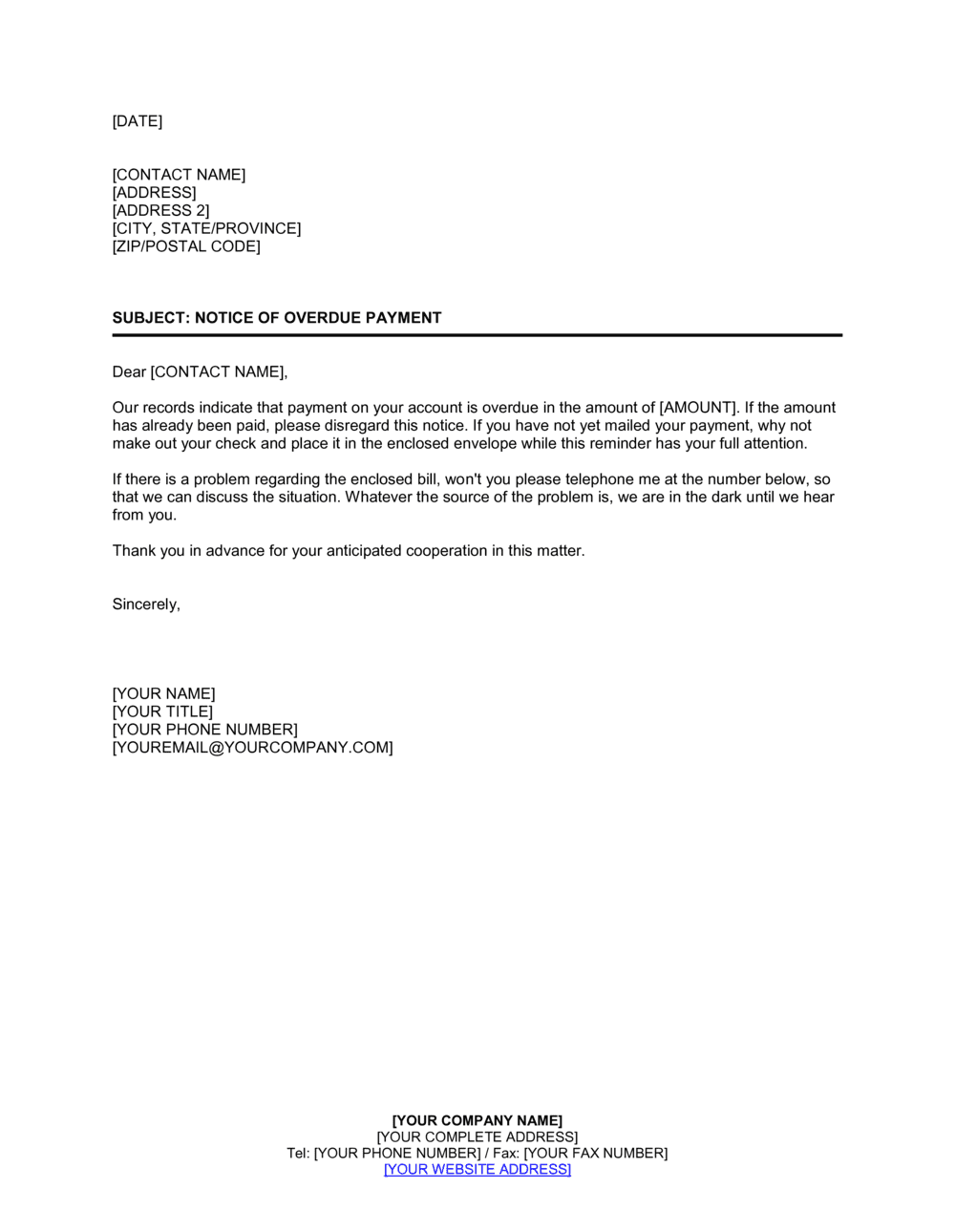

Action to be taken if payment in full is not received. Clear timeframe of when final payment is due. Advisement of the fees/dues owed (Total to include taxes, interest, penalties, or other fees incurred due to lack of payment). Clear statement advising letter is Final Demand. The letter is sent prior to a collector or financial institution filing legal action against a debtor. Get started now.A final demand letter is a letter sent in an attempt to collect a debt or repayment. Say goodbye to the stress and uncertainty of debt recovery and protect your interests with a Letter of Demand from HelloContract. Our contracts are professionally drafted and tailored to your specific needs. HelloContract is a leading provider of online agreements in South Africa, including Letters of Demand. Protect Your Interests with a Letter of Demand from HelloContract The letter must be written in clear, concise language, and must include specific details such as the amount owed, the date the debt became payable, and the date by which payment must be made. The letter must comply with the requirements of the National Credit Act, which regulates debt collection practices in South Africa. In South Africa, a Letter of Demand is not a legal requirement, but it is advisable to send one as a final attempt to resolve the issue before taking legal action. Legal Requirements for a Letter of Demand in South Africa It is a final attempt to resolve the issue before resorting to legal action. When Do You Need a Letter of Demand?Ī Letter of Demand should be sent when a debt has become overdue and the recipient has failed to respond to verbal or informal requests for payment. The letter puts pressure on the recipient to resolve the issue and avoid further legal action. It also serves as evidence in court, should legal action be necessary.įurthermore, the recipient of the letter is made aware of their legal obligation to pay the debt, and of the consequences of non-payment. It communicates your intentions clearly and provides a written record of your attempts to resolve the issue. Why You Need a Letter of DemandĪ Letter of Demand can be a powerful tool for debt recovery. It is a formal request for payment that serves as a reminder and warning to the recipient of the consequences of non-payment. Regardless of the cause, a Letter of Demand is an effective way of resolving these debts in South Africa. Debts can arise in many forms, from unpaid bills to unfulfilled promises.

0 kommentar(er)

0 kommentar(er)